Blog

Unlock Your Financial Potential Through Financial Therapy

Unlocking Your Financial Potential Through Financial Therapy

Managing personal finances can often feel overwhelming. Whether it's debt, spending habits, saving for the future, or simply trying to make sense of financial decisions, many individuals struggle with financial stress at some point in their lives. But what if there was a way to not only manage your finances better but also improve your mindset around money? That's where financial therapy comes into play. In this blog, we'll explore what financial therapy is, its benefits, and how it can help you unlock your financial potential.

What is Financial Therapy?

Financial therapy is an emerging field that combines the principles of financial planning and mental health therapy. It's designed to help individuals explore the emotional, psychological, and behavioral aspects of their relationship with money. Unlike traditional financial advisors who focus primarily on budgeting and investing, financial therapists take a deeper dive into the emotional drivers that influence your financial decisions.

At its core, financial therapy seeks to help you understand how your beliefs, past experiences, and emotions surrounding money may impact your financial choices. It's about gaining awareness of your financial behaviors and ultimately changing those patterns to create a healthier financial future.

The Importance of Financial Therapy

Financial therapy is essential because it addresses both the practical and emotional aspects of managing money. It helps individuals understand how their beliefs, behaviors, and past experiences with money impact their financial decisions.

By identifying and confronting negative financial habits, such as compulsive spending or financial anxiety, financial therapy fosters healthier financial behaviors. It also helps reduce financial stress and improve confidence in managing finances, leading to more effective decision-making. Ultimately, financial therapy empowers individuals to develop a balanced relationship with money, promoting long-term financial stability and emotional well-being.

Who Can Benefit from Financial Therapy?

Financial therapy isn't just for people who are in severe financial distress. It can be beneficial for anyone who feels uncertain or anxious about their finances. Whether you're struggling to pay off debt, trying to save for a big life goal like buying a house, or simply want to improve your overall financial well-being, financial therapy can help.

Here are some specific situations where financial therapy can be beneficial:

Struggling with Debt

If you're carrying a significant amount of debt, the emotional weight can be overwhelming. Financial therapy can help you understand the root cause of your debt (e.g., overspending, emergencies, poor financial habits) and work through the emotional barriers that may prevent you from paying it off.

Stress Around Saving for Retirement

Many people struggle with retirement savings, whether due to procrastination, fear, or confusion. Financial therapy can help you confront these emotions and create a plan that aligns with your future goals.

Couples with Financial Disagreements

Money is one of the leading causes of tension in relationships. Couples counseling with a focus on finances can help navigate financial disagreements by improving communication, setting shared financial goals, and finding solutions that work for both partners.

Anxiety About Financial Decisions

If making financial decisions makes you anxious or overwhelmed, financial therapy can help you develop a more positive and confident approach to managing your finances. This could include everything from budgeting to investing to choosing insurance policies.

Financial Life Transitions

Major life transitions—such as getting married, having a child, losing a job, or facing a divorce—can bring significant financial stress. A financial therapist can guide you through these changes and help you make sound financial decisions while managing emotional stress.

How Does Financial Therapy Work?

While the specific process may vary depending on the therapist and your individual needs, financial therapy generally follows a few key steps. Here's an overview of what you can expect when working with a financial therapist:

Exploration of Financial History

In the initial sessions, you'll likely spend some time exploring your personal history with money. This can include your upbringing, any significant financial events (e.g., debt, bankruptcy, inheritance), and the way your family or culture has shaped your attitude toward money. By understanding your financial past, you'll be able to identify any patterns or beliefs that may be holding you back.

Identifying Financial Behaviors and Beliefs

Once you've explored your history, the therapist will help you identify any specific behaviors that are negatively impacting your finances. This could include compulsive spending, avoidance of financial issues, or negative self-talk about money. You'll also discuss any beliefs you hold about money—such as thinking it's "bad" or that you'll never be able to save enough. The goal here is to uncover the emotional triggers behind your financial habits.

Setting Goals and Creating Strategies

After identifying behaviors and beliefs, the therapist will help you set realistic financial goals. These might include paying off debt, saving for a vacation, or creating an emergency fund. The therapist will work with you to develop strategies for achieving these goals while considering your emotional responses and limitations.

Working Through Emotions and Barriers

Many people experience emotional resistance when it comes to their finances. Financial therapy aims to help you confront and work through these emotions. This might involve addressing any guilt, shame, or fear you associate with money. By working through these barriers, you'll be able to develop healthier financial behaviors.

Ongoing Support and Accountability

Financial therapy is often a long-term process, and your therapist will offer ongoing support to help you stay accountable and on track with your goals. Regular check-ins and sessions will help reinforce positive changes and ensure that you're continually progressing toward financial freedom.

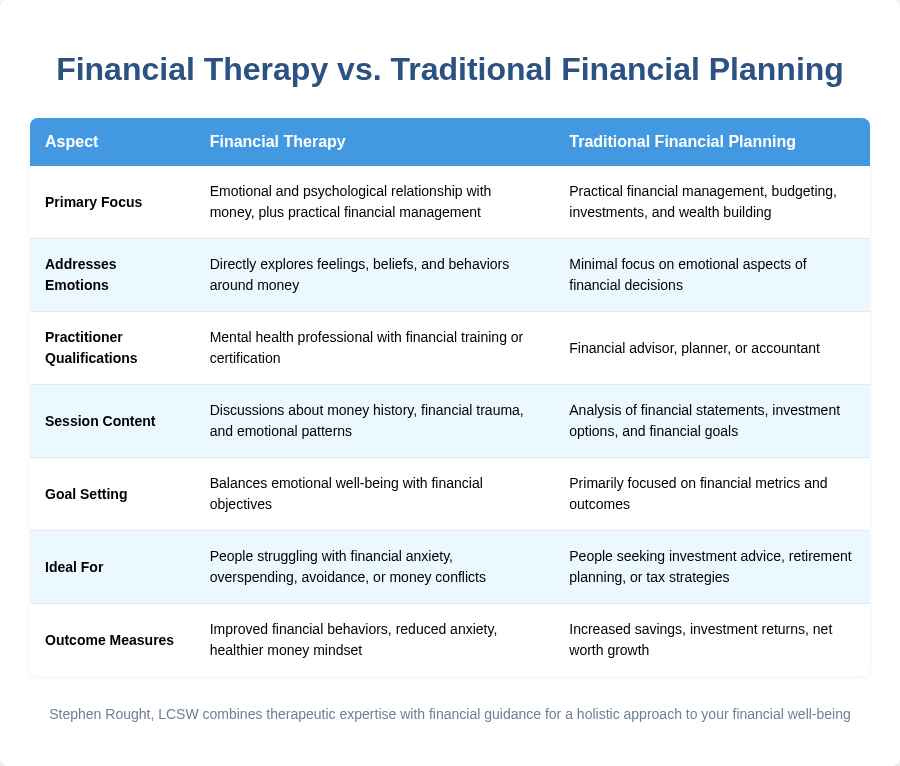

Financial Therapy vs. Traditional Financial Planning

Many people wonder how financial therapy differs from traditional financial planning. While both aim to improve your financial situation, they take different approaches and focus on different aspects of your relationship with money.

Why Financial Therapy Is Key to Transforming Your Relationship with Money

Financial therapy is a powerful tool for individuals looking to improve their relationship with money. Often, our financial behaviors are shaped by emotional and psychological factors that we may not even be aware of. Whether it's past experiences with money or societal pressures, these underlying influences can lead to poor financial habits. Financial therapy dives deep into understanding these behaviors and helps individuals break free from negative patterns.

By addressing both the emotional and practical aspects of money, financial therapy allows individuals to gain clarity and confidence in their financial decisions. It helps shift mindsets, from fear or guilt about money to a more empowered approach, allowing for healthier financial choices and ultimately leading to a more balanced and secure financial future.

How Financial Therapy Helps You Overcome Money Stress and Build Confidence

For many people, money is a source of constant stress. Financial therapy helps individuals address the root causes of their financial anxiety, such as debt, lack of savings, or overwhelming financial responsibilities. It provides a safe space to explore the emotions tied to these issues and work through them in a constructive way. Over time, this process reduces money-related stress, enabling individuals to feel more in control of their financial situation.

Building confidence around money is one of the key benefits of financial therapy. As individuals confront their financial fears and learn practical strategies for managing money, they become more empowered to make informed decisions. This newfound confidence in financial decision-making leads to a sense of freedom, allowing individuals to manage their finances with clarity and security.

Conclusion

Unlocking your financial potential through financial therapy is a transformative journey that can help you break free from emotional and psychological barriers surrounding money. By addressing both the emotional and practical aspects of your finances, financial therapy empowers you to make healthier decisions, reduce financial stress, and build long-term stability. Whether you're looking to overcome debt, save for the future, or simply gain more confidence in your financial choices, financial therapy can guide you toward a better financial future.

If you're ready to explore how financial therapy can help you reach your financial goals and improve your relationship with money, Stephen Rought is here to guide you. Offering counseling in Chino Hills and online in California, Stephen provides personalized support tailored to your unique needs. Contact us today to schedule your session and start your journey toward financial freedom and emotional balance. Let's work together to unlock your full financial potential.

Stephen Rought, LCSW Can Help You

I can help you understand the importance of mental health maintenance and getting back on track. Whether through individual therapy, couples counseling, or financial therapy, I am here to help your emotional well-being.

📞 Contact us today to start your journey toward renewed energy and emotional wellness. 📧 Email: [email protected] 🌐 Website: stephenrought.com

Stephen Rought, LCSW

Proudly Accepting

Aetna Insurance

Disclaimer

Stephen Rought, LCSW does not guarantee any specific outcome. All content provided on the Stephen Rought, LCSW website is provided for educational or informational purposes only. Consult medical professionals you are working with about whether any opinions or recommendations provided through this website apply to you and your unique circumstances

Currently, all online therapy sessions are conducted using the HIPPA compliant Telehealth service doxy.me

SErvices

Individual Therapy

Parent Coaching

Financial Therapy

Couples Counseling

Family Therapy